XRP Price Prediction: Can the Rally Defy Resistance to Hit $15?

#XRP

- Technical Resilience: Trading above 20-day MA with tightening Bollinger Bands suggests consolidation before potential breakout

- Institutional Demand: $20M treasury plans and Ripple's escrow strategy provide fundamental support

- Regulatory Catalyst: Positive legal developments could accelerate the $15 price target scenario

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge Amid Correction

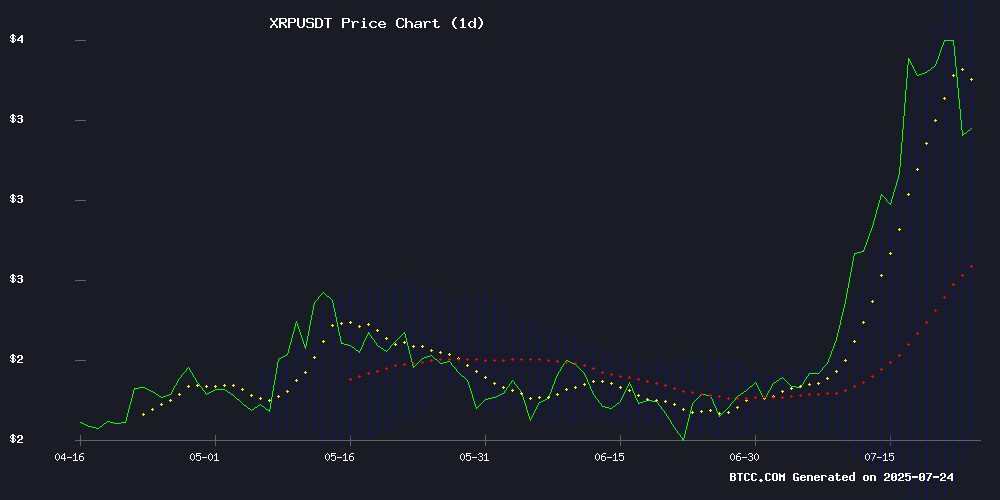

XRP is currently trading at $3.2158, above its 20-day moving average of $2.9259, suggesting underlying strength. The MACD histogram shows a narrowing bearish momentum (-0.0978), while the price sits comfortably between the Bollinger Bands ($2.0038-$3.8479). According to BTCC analyst Olivia, 'The technical setup indicates a healthy correction rather than a trend reversal, with potential for upside if $3.8479 resistance breaks.'

Mixed Sentiment as XRP Faces Macro and Regulatory Catalysts

News sentiment reflects both Optimism (Ripple's escrow strategy, institutional adoption) and caution (on-chain red flags, scam warnings). Olivia notes, 'The $20M treasury reserve news and bullish flag breakout contrast with short-term resistance concerns. Regulatory clarity remains the key driver for XRP's $15+ targets.'

Factors Influencing XRP’s Price

Nature's Miracle Plans $20M XRP Reserve Amid Token's 12% Drop

Agrotech firm Nature's Miracle unveiled plans to establish a $20 million corporate treasury reserve focused on XRP, funded through an equity financing round with GHS Investments. The announcement comes as the remittance token faces a 12% downturn in the past 24 hours.

The company intends to deploy yield strategies including staking to participate in Ripple's ecosystem. "XRP's ability to streamline cross-border payments aligns with our vision," said CEO James Li, citing adoption by financial giants like Santander and American Express.

Market reaction appears disconnected from the institutional vote of confidence, with XRP continuing its recent bearish trend. The reserve will be financed through proceeds from an SEC-approved S-1 registration.

ChatGPT’s XRP Analysis Flags Golden Cross Amid Healthy Correction

XRP shows signs of a bullish resurgence as ChatGPT's technical analysis identifies a Golden Cross formation, with the 50-day moving average crossing above the 200-day MA. The pattern emerges alongside a healthy pullback to $0.60, resetting overbought conditions while maintaining key support levels.

Institutional positioning appears to be driving the consolidation phase, with trading volumes reflecting strategic accumulation rather than distribution. The RSI at 45 and MACD histogram divergence suggest the correction remains technical rather than structural.

Market participants are monitoring two catalysts: potential SEC settlement clarity and growing Brazilian institutional adoption through approved investment vehicles. The $5 price target remains contingent on breaking the $0.75 resistance zone that has capped three previous rally attempts.

Ripple's Escrow Strategy Supports XRP Price Stability, Legal Expert Confirms

Legal expert Bill Morgan has dismissed claims that Ripple plans to dump its XRP escrow holdings, asserting the strategy instead stabilizes the cryptocurrency's price. The SEC acknowledges Ripple's escrow mechanism as a measure to support XRP's value, reinforcing investor confidence in the firm's efforts.

Morgan highlighted the consistency in Ripple's escrow holdings, noting a reduction from 55 billion XRP in 2017 to 35 billion today. Monthly unlocks of 1 billion XRP are often relocked, preventing market oversupply. This disciplined approach counters speculative 'dump theories' and underscores Ripple's long-term commitment to price equilibrium.

Ripple CEO Warns XRP Community of Escalating Scam Activity Amid Price Rally

Ripple CEO Brad Garlinghouse has issued a stark warning to the XRP community about a surge in sophisticated impersonation scams targeting investors. The alert comes as XRP's recent price appreciation attracts bad actors leveraging YouTube and AI-generated deepfakes to promote fraudulent giveaways.

Fraudsters are impersonating Ripple executives with promises of doubled investments, capitalizing on market optimism. Garlinghouse emphasized the timeless adage: "If it sounds too good to be true, it probably is." The company is actively reporting fake channels but urges community vigilance against these increasingly convincing forgeries.

This scam wave mirrors historical patterns where cryptocurrency rallies trigger amplified phishing attempts. The emergence of generative AI tools has elevated the threat, enabling scammers to produce authentic-looking content featuring cloned voices and manipulated visuals of key figures.

California AgTech Firm's Stock Surges 150% on XRP Treasury Plan

Nature's Miracle, a California-based controlled environment agriculture company, saw its shares skyrocket 150% following its announcement to establish an XRP treasury reserve. The stock surged from $0.04 to $0.14 in a single trading session—its largest daily gain in 2025.

The MOVE positions the firm among a growing cohort of public companies allocating capital to digital assets. "We recognize XRP's potential to streamline cross-border payments," said CEO James Li, citing regulatory tailwinds like the GENIUS Act as catalysts for the decision.

Strategic adoption spreads across sectors. VivoPower International committed $121 million to XRP integration, while Wellgistics Health secured $50 million for crypto treasury operations. Singapore's Trident Digital leads the pack with plans for a $500 million XRP reserve.

XRP’s Rally Could Stall—2 On-Chain Red Flags You Need to Know

XRP's recent uptrend faces potential reversal as on-chain indicators flash warning signals. Exchange reserves on Binance have surged to a year-to-date high of 2.98 million tokens, suggesting increased selling pressure. The taker buy/sell ratio has remained below one since July 10, further indicating weakening demand.

Market participants are bracing for a pullback as these metrics historically precede price corrections. The confluence of rising exchange deposits and negative buy/sell ratios creates headwinds for XRP's continued rally.

Topnotch Crypto Launches GENIUS Act-Compliant XRP Cloud Mining Contracts

Topnotch Crypto has unveiled the world's first XRP cloud mining contracts fully compliant with the GENIUS Act regulatory framework. This innovation marks a significant step in aligning cryptocurrency operations with modern financial standards, offering 8 million global users a transparent passive income channel.

The solution features smart contract-automated profit distribution, dynamic risk assessment mechanisms, and third-party audited contracts. CEO of Topnotch Crypto emphasized this isn't merely a technological product but a regulated digital asset tool meeting contemporary financial requirements.

Key features include flexible contract terms from 1-50 days, tiered daily yields of 1.2%-1.8%, and multi-signature cold wallet security. The offering represents a paradigm shift in crypto asset returns, combining regulatory compliance with competitive profitability.

Ripple (XRP) Faces Resistance After Rally, Bullish Momentum Intact

XRP surged to a new all-time high last week, briefly touching $3.6 before encountering stiff resistance. Sellers aggressively defended this level, forcing a pullback to potential support zones at $3.4 or $3. The July rally saw XRP climb from $2 to $3.6 in a dramatic two-week ascent.

Despite the retracement, higher timeframe indicators remain bullish. The weekly MACD's recent bullish crossover continues to gain strength, with histogram bars printing progressively higher highs. This suggests underlying momentum may support another upward push.

Overbought conditions on the daily RSI contributed to the rejection at $3.6. As buyers exhausted themselves, the price retreated from technically extended territory. The current cooling period could establish healthier foundations for XRP's next move.

Expert Predicts XRP Will Reach $2,000 by 2026 Amid Macroeconomic and Regulatory Shifts

Jake Claver, CEO of Digital Ascension Group, forecasts XRP could surge to $2,000 by early 2026, driven by macroeconomic realignments, regulatory clarity, and increased utility in financial settlements. Such a rally WOULD require a staggering 43,000% appreciation from current levels.

The prediction hinges on the unwinding of reverse carry trades—a strategy where investors borrow low-yield currencies to invest in higher-return assets. Claver argues this could flood digital assets like XRP with liquidity. Regulatory scrutiny on stablecoins like Tether, coupled with the recently enacted GENIUS Act, may further catalyze market momentum.

Ripple's native token faces a pivotal juncture. Its adoption for cross-border settlements and the resolution of its SEC lawsuit could either validate bullish projections or expose them as speculative euphoria. The market watches for whether XRP's utility can outweigh the sector's regulatory headwinds.

XRP Jumps 4% Amid Technical Breakout and Regulatory Tailwinds

XRP rallied 4% between July 22-23, climbing from $3.42 to $3.57 before settling NEAR $3.51. The move confirmed a breakout from a six-year symmetrical triangle pattern, fueled by surging trading volume and two catalytic developments.

U.S. legislative progress on the GENIUS and CLARITY Acts provided regulatory clarity, while ProShares' launch of the first XRP futures ETF signaled growing institutional interest. The $3.52 resistance breach saw volume spike 52% above average, though late-session profit-taking trimmed gains.

Technical indicators remain neutral, with $3.50 emerging as critical support. Analysts see potential for $6.00 near-term and $15.00 longer-term if the breakout sustains. Market participants now watch institutional flows and broader crypto ETF developments for continued momentum.

Ripple’s XRP Breaks Out of Bull Flag as Traders Target $15

XRP has surged past the $3.50 resistance level, confirming a bullish breakout from a flag pattern that had constrained its price action since late 2024. Analysts now project a potential rally toward $15, citing the weekly chart's technical structure as the foundation for this optimistic outlook.

The momentum is further supported by a bullish MACD crossover, while Fibonacci retracement levels suggest $5.32 as the next critical resistance zone. Should a pullback occur, traders anticipate strong support between $2.70 and $3.00.

Despite the technical optimism, regulatory headwinds persist. The SEC has unexpectedly blocked Bitwise's proposed XRP-inclusive ETF, casting doubt on the near-term viability of altcoin-based exchange-traded funds.

Is XRP a good investment?

| Metric | Value | Implication |

|---|---|---|

| Price | $3.2158 | 12% below recent highs |

| 20-day MA | $2.9259 | Support level holds |

| Bollinger Bands | $2.0038-$3.8479 | Room for volatility |

Olivia concludes: 'XRP presents a high-risk, high-reward opportunity. The $2.92 MA support and institutional adoption (like Nature's Miracle's reserve) counterbalance short-term bearish MACD signals. Investors should watch the $3.85 breakout point.'

XRP shows mixed signals but retains bullish potential. Key factors include institutional adoption, regulatory developments, and technical support at $2.92.